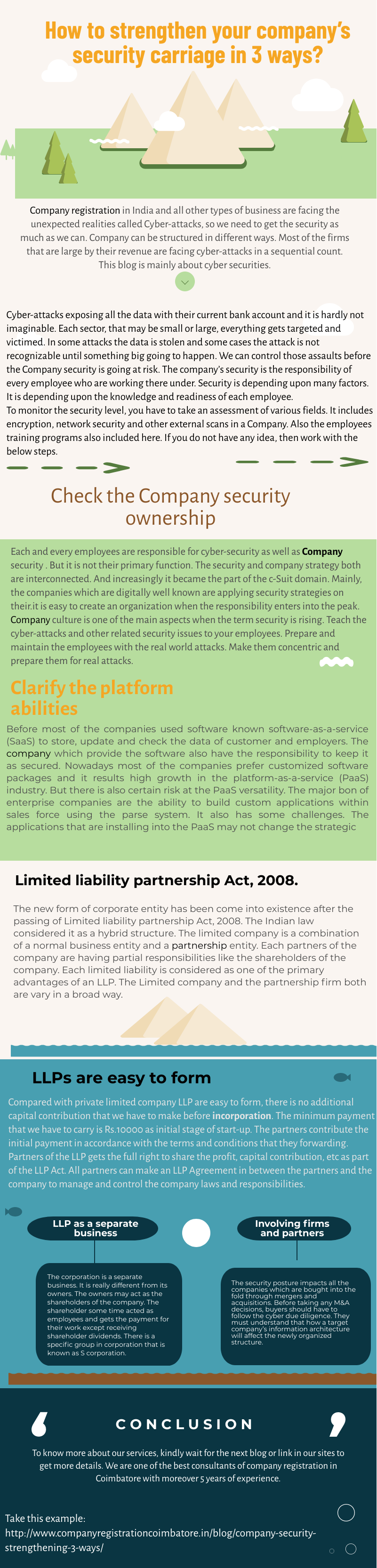

Company registration in India and all other types of business are facing the unexpected realities called Cyber-attacks, so we need to get the security as much as we can. Company can be structured in different ways. Most of the firms that are large by their revenue are facing cyber-attacks in a sequential count. This blog is mainly about cyber securities.

Cyber-attacks exposing all the data with their current bank account and it is hardly not imaginable. Each sector, that may be small or large, everything gets targeted and victimed. In some attacks the data is stolen and some cases the attack is not recognizable until something big going to happen. We can control those assaults before the Company security is going at risk. The company’s security is the responsibility of every employee who are working there under. Security is depending upon many factors. It is depending upon the knowledge and readiness of each employee.

To monitor the security level, you have to take an assessment of various fields. It includes encryption, network security and other external scans in a Company. Also the employees training programs also included here. If you do not have any idea, then work with the below steps.

Check the Company security ownership

Each and every employees are responsible for cyber-security as well as Company security . But it is not their primary function. The security and company strategy both are interconnected. And increasingly it became the part of the c-Suit domain. Mainly, the companies which are digitally well known are applying security strategies on their.it is easy to create an organization when the responsibility enters into the peak. Company culture is one of the main aspects when the term security is rising. Teach the cyber-attacks and other related security issues to your employees. Prepare and maintain the employees with the real world attacks. Make them concentric and prepare them for real attacks.

Clarify the platform abilities

Before most of the companies used software known software-as-a-service (SaaS) to store, update and check the data of customer and employers. The company which provide the software also have the responsibility to keep it as secured. Nowadays most of the companies prefer customized software packages and it results high growth in the platform-as-a-service (PaaS) industry. But there is also certain risk at the PaaS versatility. The major bon of enterprise companies are the ability to build custom applications within sales force using the parse system. It also has some challenges. The applications that are installing into the PaaS may not change the strategic

The applications you create within PaaS may not directly change your strategic carriage. They are complex, and it requires some planning to get manage.

Involving firms and partners

The security posture impacts all the companies which are bought into the fold through mergers and acquisitions. Before taking any M&A decisions, buyers should have to follow the cyber due diligence. They must understand that how a target company’s information architecture will affect the newly organized structure. You have to validate the third party vendors and partners. The weakness in the retailor database may expose the customers and employees. It means the overall security posture is strong as the partner. Manufacturers of the security posture must be companywide objective. All the members of the company should understand how to maintain it and why they should. Start the day with the below steps to avoid cybercrime statistic. Here in the next blog let us discuss about the Limited liability partnership and its effect in the cyber-security statistic.

Limited liability partnership Act, 2008.

The new form of corporate entity has been come into existence after the passing of Limited liability partnership Act, 2008. The Indian law considered it as a hybrid structure. The limited company is a combination of a normal business entity and a partnership entity. Each partners of the company are having partial responsibilities like the shareholders of the company. Each limited liability is considered as one of the primary advantages of an LLP. The Limited company and the partnership firm both are vary in a broad way.

The share of each partner is restricted to the amount of contribution made by each of them. We can register our LLP with the help of expert’s team in each consultant. They are highly qualified to give a full glance of its most important features before we dive into the LLP Registration process. We already talked about the liability of the partners; those are limited to the amount of their initial investment.

LLPs are easy to form

Compared with private limited company LLP are easy to form, there is no additional capital contribution that we have to make before incorporation. The minimum payment that we have to carry is Rs.10000 as initial stage of start-up. The partners contribute the initial payment in accordance with the terms and conditions that they forwarding. Partners of the LLP gets the full right to share the profit, capital contribution, etc as part of the LLP Act. All partners can make an LLP Agreement in between the partners and the company to manage and control the company laws and responsibilities.

LLP is having lesser compliance and more security when compared to private limited firm. There is no compulsory audit. But when the turnover exceeds Rs. 40 lacs or the capital contribution reach INR 25 lacs, there must precede some audit. LLP saves your time money and efforts and also gives better security. Because it does not require any board meeting and annual meetings as part of the company.

For LLP registration it require two designated partners. They can be natural person and one of them must be an Indian resident. Each body corporate can act as designated partners. Thus all the designated partners are partners of an LLP. There are 3 different types in a business organization. Choosing the correct one is mandatory to make the Company security . Corporation, multiple owner business and single owner business. These are 3 categories. Let us discuss about the 3.

LLP as a separate business.

The corporation is a separate business. It is really different from its owners. The owners may act as the shareholders of the company. The shareholder some time acted as employees and gets the payment for their work except receiving shareholder dividends. There is a specific group in corporation that is known as S corporation. After the formation of corporation we are electing the S status. Several individual are forming a multiple owner business and there include partnership and limited liability companies. These owners of the multiple system shares the profits and losses of the business. The single owner business is operated by a single person and it exists in single owner LLC Company. There is no need to register a sole proprietor business within the state. If we want to select a business type there are four factors to consider with, the factors are listed below,

How can we register a business? The procedures and the cost of such business. The role of owners in a company and how they are getting money via ownerships. Another important consideration is taxes and how they are paying. These are the overall view about LLP.

To know more about our services, kindly wait for the next blog or link in our sites to get more details. We are one of the best consultants of company registration in Coimbatore with moreover 5 years of experience.

Thank You!!!!!!!

No Comments